How to budget for Christmas

Discover our top tips for a budget-friendly Christmas, from upcycled woodland decorations to low-cost present ideas.

December and Christmas bring with them festive tidings and cheer – but also their own share of financial pressures. While Brits deal with an ongoing cost of living crisis, we wanted to examine how spending habits are changing compared to the festive period last year.

As part of our ongoing work to support financial education and awareness, we conducted a nationwide study into how people are feeling about their finances this Christmas.

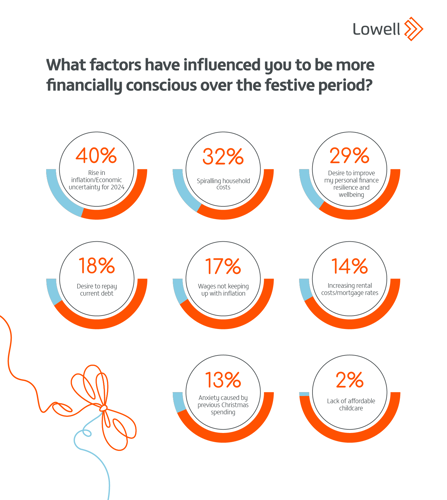

Our study revealed that the rising cost of living is definitely having an impact, and as a result, people are prioritising their finances and planning to be more money-conscious this Christmas. Two-thirds of Brits (64%) are planning on prioritising their money management this Christmas, compared to just a quarter (25%) last year.

And while a third (33%) of people in the UK plan to not exchange gifts this Christmas to try and be more financially savvy, the good news is that the pressure to overspend at Christmas has dropped year-on-year.

Let’s take a look into the data and our survey responses – and for more insight into last year’s research take a look at the financial pressures Brits faced in Christmas 2022.

The pressure to spend around Christmas is intense from the pressures of social media and advertising, which can be really difficult if you’re trying to stick to a budget. In fact, 24% of the people we surveyed felt that they needed to deliver the perfect Christmas for their family, and a huge 68% of Brits feel pressure from social media, TV advertising, friends and family to spend more in 2023.

Despite the encouragement to spend more, encouragingly, the number of Brits feeling pressure to buy more than is needed over the festive period has dropped from 34% last year, to 30% in 2023.

At Lowell, we are committed to reducing the stigma around debt. We understand that Christmas pressure can lead people to spend beyond their means – and our research last year showed that 24% of people in the UK took six months to pay off debt accumulated over the festive period.

But this, year the majority of people (38%) plan to have everything paid off within a month. Let’s take a look at why and how people are planning to be more financially conscious despite ongoing pressures to spend more.

Compared to 2022, 39% more Brits are determined to be money-savvy throughout December to have the best Christmas possible without putting themselves under financial strain.

A further 29% wanted to improve their personal finance resilience and wellbeing, to help deal with debt-related stress.

18% want to prioritise paying off current debt, whilst 32% are cutting back on Christmas spending due to spiralling household costs.

Last year, more than half (51%) used their savings to fund their Christmas. However in 2023 that has reduced by 5%, with more Brits opting to budget with their disposable income (57%).

Encouragingly, less people are using credit cards and ‘buy now, pay later’ schemes this year compared to last, with a combined reduction of 6% year on year.

Christmas is an expensive time of year, but it’s important to keep on top of your finances as much as possible. It might not feel like a huge issue to depend on credit now, but longer-term this could lead to problem debt if you can’t keep up with payments, which could impact your credit score. To find out more, check out our guide on how your credit file affects you.

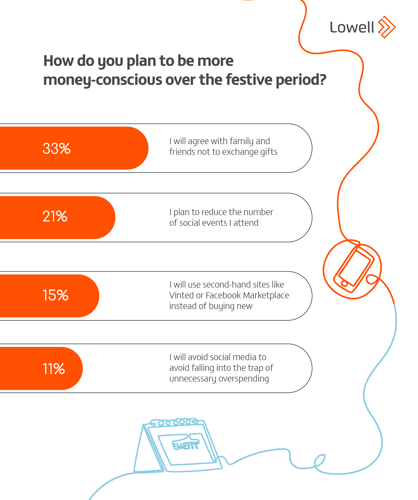

It can be tough to be money-conscious around Christmas – with so much pressure to buy presents, decorations, food, and cards, it feels like a long list, and it can be tough to tell where you can cut back. With this in mind, we asked our survey participants how they were planning on being more money-conscious this Christmas.

It’s easy to think that most of the spending around Christmas is on presents or trimmings, but there’s also pressure to see and do things in December, like Christmas days out, trips to see markets or Christmas lights, parties, and more.

Because of this, some of our survey responders were planning on cutting down on their social obligations around the festive season: 21% of Brits were planning on reducing the number of social events they attend this Christmas to help manage their money.

When it comes to gifting, people are also trying to be more money-savvy, with 15% planning to shop at second-hand sites such as Facebook Marketplace and Vinted, while 11% are going to avoid social media to prevent unnecessary spending and a third (33%) have even agreed with their family and friends to not exchange gifts at all.

We’ve put together some ideas and inspiration for saving on Christmas this year. For more tips, head to our guide on how to budget for Christmas, with budget and low-cost ideas for thoughtful Christmas gifts, and suggestions for how to save around the big day.

As a result of COVID and the cost-of-living crisis, the traditional sense of how Christmas ‘has to be’ has shifted – allowing people to think about new ways of enjoying the holidays. The shifts in perception show that Brits are planning to do what they can to enjoy the festivities, without putting themselves in financial difficulty where possible.

At Lowell, we know and understand that you might be worried about your debt this Christmas, but there’s always help available. If you’re a customer of Lowell, please get in touch with our friendly and supportive team who are always here to listen and find the best option for you.

Published by Stephanie North-Shaw on 19th November 2023

Discover our top tips for a budget-friendly Christmas, from upcycled woodland decorations to low-cost present ideas.

We understand that dealing with debt can be overwhelming and cause stress. To help ease your mind, read our guide on how to deal with debt-related stress.

There are lots of ways that Lowell can offer you additional support with your debt. Find out how we can help you today.