Debt Decoded: The Cost of Online Debt Misinformation

What social media isn’t telling you about getting out of debt

Social media can be both a blessing and a curse. While it helps people connect with others from around the world, it’s also a hub of unverified information. People can give their opinion and advice on anything, even if they don’t have the right credentials or experience to be an authority in that space.

Debt is one area where this can be especially harmful. Despite the stigma that surrounds it, debt is far from rare. The Financial Conduct Authority (FCA) estimates that 88% of people in the UK who held credit or loan products in 2024 were over-indebted.

With so many people experiencing debt, it’s natural to seek online help for repayment guidance. However, advice on social media specifically comes with its own challenges of debt misinformation.

TikTok influencers. Anonymous Reddit threads. Facebook group admins with affiliate links. When it comes to advice about money, the internet’s loudest voices aren’t always the most reliable or verifiable.

And the risks are real. A recent TSB survey revealed that of the 31% of people who acted on financial advice they found on social media, more than half (55%) ended up losing money as a result.

To understand the scale of the issue, the team at Lowell have partnered with free debt advice provider, Money Wellness to explore how debt is discussed on social media, revealing the extent of misinformation being shared and the risks it poses to those searching for genuine support.

In this study, we’ll cover the following:

- What is misinformation?

- How Lowell is tackling debt misinformation

- Key findings

- How far does debt misinformation travel?

- The extent of debt misinformation

- The most toxic platform for misinformation

- Debt-fluencers

- Real people, real harm

- The top debt myths, debunked

- Who you can trust and where to turn instead

- Final thoughts

This content is intended to be an impartial study on debt misinformation online. Lowell Financial Ltd does not offer financial, legal or debt advice. You can find out more about the organisations you can contact in our guide on debt help and support.

What is misinformation?

False information online can take many forms. Not everyone who spreads it realises they’re doing so, or that it can harm others.

This is particularly true in the world of debt advice. People often share personal experiences with the best intentions, but what worked for one individual may not apply to someone else’s circumstances. When others act on that advice, it can backfire, leaving them worse off financially in the long run.

That’s why this report distinguishes between misinformation and disinformation. Though often used interchangeably, the two describe very different kinds of falsehoods.

- Misinformation is false or inaccurate information shared without intent to mislead. It often comes from misunderstandings, misreporting, or simply repeating something believed to be true. For instance, sharing an outdated statistic as fact is misinformation.

- Disinformation, on the other hand, is deliberately false information designed to deceive. It’s often used to influence what people think by spreading fake stories or misleading claims.

The key difference is intent: misinformation misleads by accident, while disinformation misleads on purpose. Both can be damaging, but disinformation is especially dangerous because it turns communication into a weapon.

Most people sharing poor debt advice on social media aren’t intentionally lying. Often responding to those in stressed and vulnerable situations, they may repeat guidance that worked for one particular set of circumstances, that may unintentionally put others at risk.

It’s important to make a clear distinction here: people seeking debt support online can access free, regulated advice via the right channels—for example, official government or charity services. This is very different from relying on guidance found on social media, blogs, or forums, where advice may be well-meaning but inaccurate.

How Lowell is tackling debt misinformation

We worked with Money Wellness, a free debt advice provider, who analysed over 981 pieces of content from TikTok, Reddit, and Facebook that provided advice to people in debt.

Key findings

- Almost two thirds (64.22%) of debt advice on social media is misleading while up to 98.27% is unreliable.

- Facebook proved to be the least transparent platform for debt advice with 100% of the content categorised as unreliable.

- Almost a quarter (23.96%) of debt advice shared on social media promotes a specific product or service to vulnerable individuals.

- Almost 29% of debt advice claimed unrealistic outcomes, providing false hope to those in vulnerable situations.

- Almost two-thirds (64.22%) of debt advice recommended a one-size-fits-all approach, without considering individual circumstances.

- Only 1.7% of those giving debt advice on social media had a relevant verifiable credential, with the remaining 98.3% lacking the training to support those with challenges.

How far does debt misinformation travel?

Debt misinformation doesn’t just stay in small corners of the internet, it spreads quickly across platforms where financial conversations are thriving. Communities, hashtags, and groups dedicated to “debt help” attract huge audiences, meaning misleading or overly simplistic advice can travel far and fast.

Online finance subreddits in the UK attract massive audiences, with some communities hitting 1.8 million members, almost the entire population of Northern Ireland, putting them in the top 1% of Reddit communities overall. While much of the discussion is responsible and well-moderated, the scale of its audience means that even a single misleading comment has the potential to reach thousands of people.

Debt support groups are also highly active on Facebook, where demographics skew slightly older. A certain benefit, debt and bailiff support group has 20,400 members, while a more general debt group has a further 1,500 members. These forums often feel like safe spaces, but with thousands of people seeking answers, unverified advice can spread unchecked.

On TikTok, financial hashtags generate enormous traction. The hashtag #debtfree has been used in more than 381,400 posts, while #debtfreejourney appears in around 378,100 videos. With TikTok’s algorithm amplifying content based on engagement rather than accuracy, even a single misleading tip can rack up millions of views in a short time.

Debt misinformation has an extensive reach, spanning millions of users across platforms. This makes it all the more critical to separate personal anecdotes from expert guidance before advice is repeated, shared, or acted upon.

The extent of debt misinformation

Misinformation can be damaging for those who already find themselves in debt and are looking for ways to improve their situation.

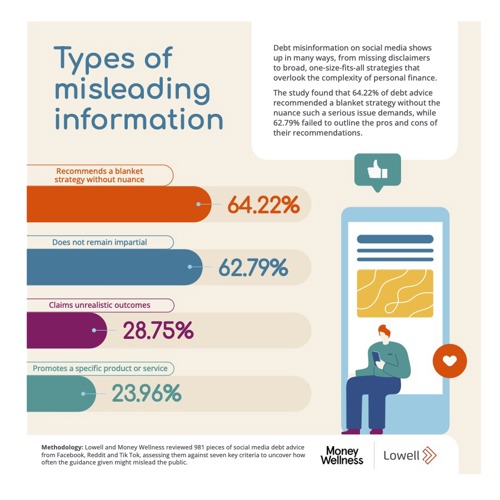

The research found that almost two thirds (64.22%) of all the debt advice analysed fell into this “misleading” category. That means the majority of people turning to online communities for support are at risk of being guided by information that could worsen their financial difficulties rather than help resolve them.

Matthew Sheeran, Debt Advice Specialist at Money Wellness comments on the findings: “It’s alarming, but sadly not surprising. Online platforms are flooded with quick-fix solutions that often oversimplify complex financial issues. We see firsthand how this misinformation can push people further into debt. It reinforces why regulated, professional advice is so crucial. Debt is complex, so a one-size-fits-all approach doesn’t work.”

The study also delved into the specific types of misinformation being peddled by online social media users.

When it came to practical strategies for getting out of debt, 64.22% of the advice offered was overly generic, lacking any consideration for individual circumstances. These strategies could look like someone suggesting they consolidate loans to one 0% credit card, “just budgeting better,” or seek a financial service such as an IVA or bankruptcy. While these approaches can be useful in the right context, applying them blindly can leave people worse off and even deepen their financial struggles.

Almost two thirds of advice (62.79%) gave real ways to deal with debt without showing the potential downsides, costs, or long-term consequences. For example, although many people advised an IVA as a way to “wipe debt”, it failed to mention that those who took this route may end up paying added fees and negatively affect their credit score.

28.75% of advice promised unrealistic outcomes such as specific but extreme timeframes (“in 7 days,” “in one month”) or used language such as “guaranteed” or “no matter your situation”. This kind of wording gives people false hope that debt problems can be solved quickly and easily, which can delay them from seeking realistic solutions.

Worryingly, the study also discovered that a lot of debt advice had a commercial angle as 23.96% promoted a specific product or service. Some of this promotion is fairly innocent such as recommending specific debt charities or helplines. However, other advice suggested those in debt should sign up for specific 0% credit card accounts or follow certain YouTubers. Some advice even went as far as to promote their own services as unofficial “financial advisors” promising to “clear debts”.

The most toxic platform for misinformation

Debt misinformation is rampant on social media, with some platforms encouraging quick, bold claims and unverified advice that can spread unchecked, making it hard for users to find reliable guidance.

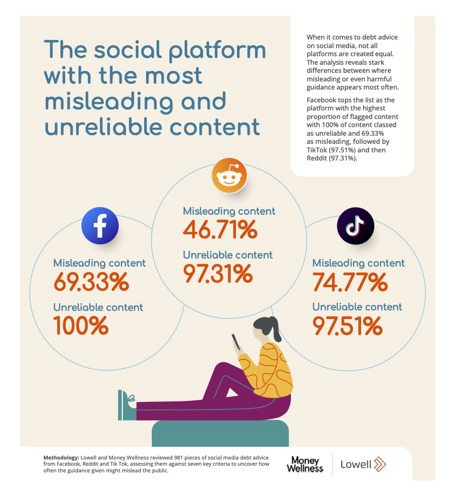

The study revealed that Facebook emerged as the worst platform for debt misinformation, with 100% of advice classed as unreliable and 69.33% as misleading. This is largely because nearly all advice comes from users without the relevant credentials, and almost none (0.3%) cite credible sources.

Meanwhile TikTok is filled with quick-fix debt content, with 97.51% of posts identified as unreliable and 75% as misleading. Over 40% promise unrealistic results, and a third promote products or services, making it the hub for influencer-driven “miracle cure” advice.

Reddit scrapes through as the least toxic platform. While 97.31% of advice comes from users with no credentials and 86% lacks sources, it has fewer product promotions (17%) and unrealistic promises (18%), suggesting discussions are more community-driven and nuanced.

Matthew Sheeran, Debt Advice Specialist at Money Wellness comments on the findings: “These platforms reward content that’s fast, catchy and easy to share. This can come at the expense of accuracy. Debt advice that promises instant solutions or dramatic results gets

more likes and shares than measured, realistic guidance. Unfortunately, this means people see the most sensational tips first, rather than a more balanced viewpoint. Also, not everyone is aware that free debt advice is available and so this may be a driver for people turning to social media for help.”

Debt-fluencers

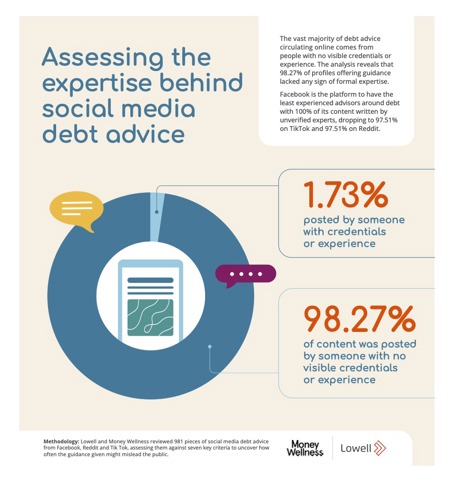

A big problem with debt guidance circulating on social media platforms is the source. Anyone can post tips on social media with no credentials or experience. “Debt-fluencers” often share personal stories or viral tips, not expert guidance, which lets harmful advice spread fast.

98.27% of debt advice was given by someone with no visible credentials or experience. This meant that their advice couldn’t be verified and therefore could be wholly inaccurate. Some users claimed to be “debt advisors” but without any credentials, it could actually cause more harm than good, with users trusting their advice more.

Matthew Sheeran, Debt Advice Specialist at Money Wellness provides tips on what credentials someone should look for in a legitimate debt advisor: “You need to look for organisations that are FCA regulated and can demonstrate experience in debt advice. Qualified advisers will provide personalised guidance, explain risks clearly and won’t pressure you to make hasty decisions. They’re also non-judgemental and confidential, so you shouldn’t feel ashamed or embarrassed about sharing your problems.”

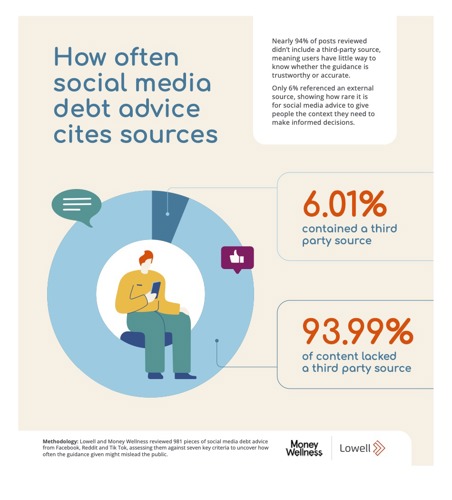

The study found that 93.99% of debt advice lacked a financial disclaimer, meaning audiences may treat anecdotal or personal experiences as universally applicable or expert-backed. It also encourages overconfidence in advice that hasn’t been vetted, regulated, or tailored to the audience’s situation. As of September 2025, there is no UK law that requires social media influencers to provide a disclaimer clarifying that their content is not professional financial advice, unless related to investments.

A staggering 93.99% of debt-related content cites no third-party sources, making it impossible to verify whether claims are accurate, up to date, or relevant. This lack of accountability allows misinformation to spread unchecked, especially on social platforms where engagement often outweighs accuracy.

Real people, real harm

When it comes to debt, the wrong advice can trap someone in years of unnecessary struggle. Money worries can already create stress, but following guidance that isn’t tailored to a person’s full situation can make those problems even worse.

Money Wellness regularly see the real-life consequences of this, where people come to them after being steered down the wrong path. They recount the story of Matthew who took unregulated debt advice from social media.

“We certainly do come across cases where someone’s situation has been made worse due to bad advice.

“Matthew came to us facing severe financial hardship following the breakdown of his 18-year marriage and a significant cut in his working hours. He’d previously been advised that his best option was to make reduced payments to his lenders through a debt management plan (DMP). A DMP can be a great option for people who have enough disposable income to pay off their debts within a reasonable amount of time.

“But Matthew had virtually nothing left after covering his essential costs each month. The fact there was no end in sight to Matthew’s financial difficulties had a devastating effect on his mental health.

“By the time he turned to us, he described himself as “very stressed”, was suffering from depression and struggling to get any sleep at night. After we went through his full circumstances, we found he was actually eligible for a debt relief order. This meant his debts were frozen for 12 months and then written off, giving him the opportunity for a fresh start rather than being left to chip away at his debt for the foreseeable future.

“His case highlights the importance of speaking to a qualified professional who will consider all your options rather than pushing one specific solution.”

“Bad debt advice can be devastating. It’s like being scammed. People often feel embarrassed about taking bad advice, and this can prevent them from seeking professional help, which further damages their financial situation.”

The top debt myths, debunked

When searching for answers about debt on social media, it’s easy to come across advice, tips, and so-called “loopholes”. And while some of this information can be helpful, a lot of it is based on myths or misunderstandings that can prevent you from finding the help you need.

We've created a series of guides about the most common debt myths online, explaining what really happens in those situations.

For example, some people believe that if they simply ignore their debt long enough, it will disappear. While it’s true that debts can become statute barred after a certain period, this doesn’t mean they’re automatically written off – they still legally exist, and creditors may continue to contact you or attempt to collect. In addition, the debt’s presence on your credit file can still impact your credit score and your ability to get future credit, including a mortgage.

You can find out more in our guide on what happens if you ignore debt collectors.

For more information, our blog explores the truth behind online debt myths linked to Lowell.

Who you can trust and where to turn instead

If you’re feeling overwhelmed by debt, remember: help is available, and you don’t have to face it alone. Unlike much of the advice on social media, the guidance you’ll find through trusted channels is reliable, realistic, and focused on your wellbeing.

For independent support, visit Lowell’s Help & Support Hub for free, confidential debt advice from qualified professionals.

If you’re ready to take the next step, Lowell’s advisors can help you understand your options, create a plan that works for your situation, and guide you safely toward financial recovery.

Final thoughts

It’s easy to blame the individuals sharing misleading debt advice on social media, but the bigger problem often lies with the platforms themselves. Social media is designed to reward engagement over accuracy, which means content that is shocking, emotional, or oversimplified spreads faster than careful, fact-checked guidance.

“[Misinformation is] really a function of the structure of the social media sites themselves.” - Wendy Wood, USC expert on habits in an interview with USC Today (USC, 2022).

Platforms can and should do more to protect users seeking genuine advice. This could include:

- Flagging unverified financial advice and highlighting content from accredited, regulated sources.

- Prioritising expert content in feeds and search results for financial queries.

- Providing disclaimers or educational nudges when content discusses debt solutions or financial products.

- Limiting the reach of posts that make unrealistic promises or push products with hidden incentives.

Don’t let the loudest voices dictate your financial decisions. Seek guidance from independent regulated sources such as qualified debt advisors who provide reliable, professional support focused on your wellbeing.

Methodology

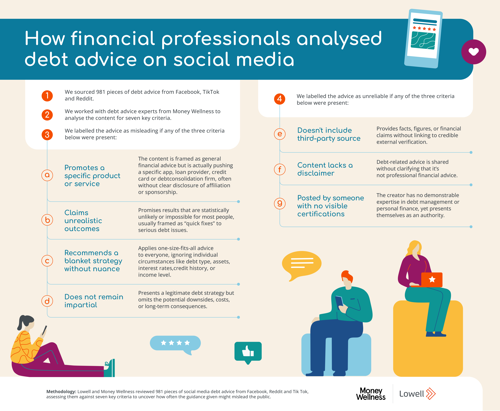

We pulled a sample of 981 pieces of UK debt advice from Facebook, Reddit and TikTok by tracking popular debt related hashtags and debt help groups. We then had the videos analysed by qualified financial professionals from Money Wellness.

They categorised the content by seven key criteria which hints at debt advice shared on social media being misleading or unreliable.

The content was classed as ‘misleading’ if it met any of the following criteria:

- Promotes a specific product or service

- Claims unrealistic outcomes

- Recommends a blanket strategy without nuance

- Does not remain impartial

The content was classed as ‘unreliable’ if it met any of the following criteria:

- Doesn't include third-party source

- Content lacks a disclaimer

- Posted by someone with no visible credentials or experience

We then calculated the overall percentage of content that was classed as misleading or unreliable, as well as platform specific breakdowns.

The data was collected and analysed in August 2025.

First published: 14th October, 2025.