The impact of money problems on relationships

Money problems can impact relationships from friends and family to your significant other, read on to discover what research uncovered on the matter.

Originally an American tradition, Black Friday has quickly become one of the most anticipated dates for both shoppers and retailers. The main draw for most Brits is the idea that you can get your hands on some of the year’s best discounts and deals.

However, research by Finder1 has revealed that 45% of Brits are choosing to prioritise their financial well-being and are estimated to spend £900 million less than last year.

Considering the fact that it’s such a big event along with the findings from Finder, we wanted to conduct our own research2 delving into how Brits are approaching Black Friday this year.

Just keep on reading to see what we found out along with ways you can still shop during Black Friday whilst being considerate when spending!

When it comes to the ways in which Brits are being more careful with their money ahead of Christmas, our research discovered that a third of Brits have already agreed to not exchange gifts with family and friends.

Not everyone is keen to stop the tradition of gift giving though with 15% being more money-savvy and shopping for presents on second-hand sites Vinted or Facebook Marketplace instead of buying new.

Over one in five (21%) have decided that one way they can keep costs down over the festive period is by being pickier with what sort of social events they decide to attend.

Seeing things online can also lead to spur-of-the-moment orders, and 11% of respondents told us that they’re going to try to avoid social media and falling into the trap of unnecessary overspending.

As there’s such a build-up to Black Friday, some people do start getting prepared and researching what they might want to buy early on.

According to our research, over a quarter of Brits (27%) monitor the price of an item before Black Friday and will only buy it if it goes on sale. Meanwhile, 10% of respondents said that they leave it until the day of when they end up impulse-buying deals that grab their attention.

However, is it worth doing any research before Black Friday? Well, it turns out that it might be worthwhile for your wallet. In fact, 6% of respondents told us that they ended up spending more than they could afford during the flash sales because they didn’t do any prior research.

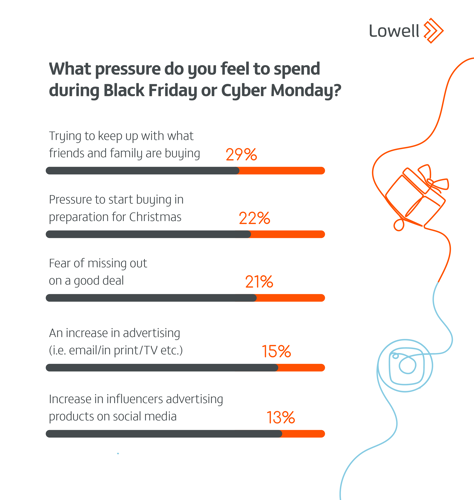

Trying to keep up with what friends and family are buying is revealed to be the top reason for falling into the Black Friday hype for just under a third of respondents (29%). From new gadgets to the latest clothing trends, there’s always going to be something new on the market.

Preparing for Christmas is another factor that urges over two in ten Brits to spend during Black Friday and Cyber Monday. Given the fact that the sale event takes place over the final weekend of November, this makes a lot of sense.

It can be hard to resist the temptation of a good deal, and 21% of respondents even said that the fear of missing out is what pushes them to spend during Black Friday sales. Some other pressures uncovered in our research come down to an increase in advertising whether that be via email, print, and TV (15%) or influencers on social media (13%).

Heading into Black Friday, there are some things you can do to manage your spending and stay on track. Below are three ways you can avoid overspending and come out of the sales while still in control of your finances.

It may sound obvious, but it’s always wise to head into Black Friday, and the festive period overall, with a budget in mind. That way, you know what you can afford to spend, and you’ll be able to better prioritise your purchases.

If you’re not sure where to get started, we’ve got a handy budget calculator tool that you can try out. All you need to do is put in some details regarding your incomings and outgoings for an overview of your finances.

It’s easy to add things to your basket, especially when they’ve got an attractive discount sign attached. However, do you really want or need whatever it is?

Instead of just being swept up in the moment, take a moment to second-guess your purchases so that you don’t end up spending money unnecessarily. Basically, being mindful of your spending is key.

Whilst, in theory, prices should lower during Black Friday, there’s still a chance that you might not be getting the best deal. You can get a better idea of what looks like a good discount by doing some research and comparing prices beforehand.

As part of this, you can also check if certain retailers have some sort of price match promise. This is especially good if you’re already planning on ordering something else from them.

Whatever you’re after, you’ll be able to find someone selling it. From Vinted to Facebook Marketplace, you can find some great deals when you shop second-hand.

Not only will you save even more money but it’s also better for the environment and encourages sustainability.

If you’re a Lowell customer and are worried about your debt in the lead up to Black Friday, please get in touch with us to see how we can help. For more finance-related research and information on managing debt, check out the Lowell blog.

Published by Stephanie North-Shaw on 26th September 2023

Methodology

Money problems can impact relationships from friends and family to your significant other, read on to discover what research uncovered on the matter.

Many families are facing financial difficulties due to the cost-of-living crisis and new research by Lowell reveals just the true cost behind having a family.

There are lots of ways that Lowell can offer you additional support with your debt. Find out how we can help you today.