How soon can you be debt-free with Lowell? Let’s find out

Debt can knock your life off the rails. Paying it off sooner can help you get it back on track faster. Even a small change to what you pay each month can make a big difference

Speed up the day when there’s no more to pay

You could be free from your Lowell debt earlier than you think.

Why people want to pay a little more each month

The sooner you pay off your Lowell debt, the sooner you can relax a little.

- Paying off your Lowell debt sooner can lift a weight off your shoulders

- One less debt hanging over you is one less thing to worry about

- You may improve your credit rating, which could help you in the future

Try our budget calculator to work out what you can afford

Understanding your incomings and outgoings can help you manage your money.

- Our free online budget calculator gives you a clear view of your finances

- Keep track of exactly where your money's going

- Easy to use

See how quickly you can be free of your Lowell debt

Even a small change in what you pay can make a big difference to how long it takes to pay off your Lowell debt. Our Debt repayment calculator shows you what happens if you pay a little more. It’s very simple to use so just have a play around with it. You might be surprised how soon you can say goodbye to us if you pay a bit more each month.

A small change can make a big difference

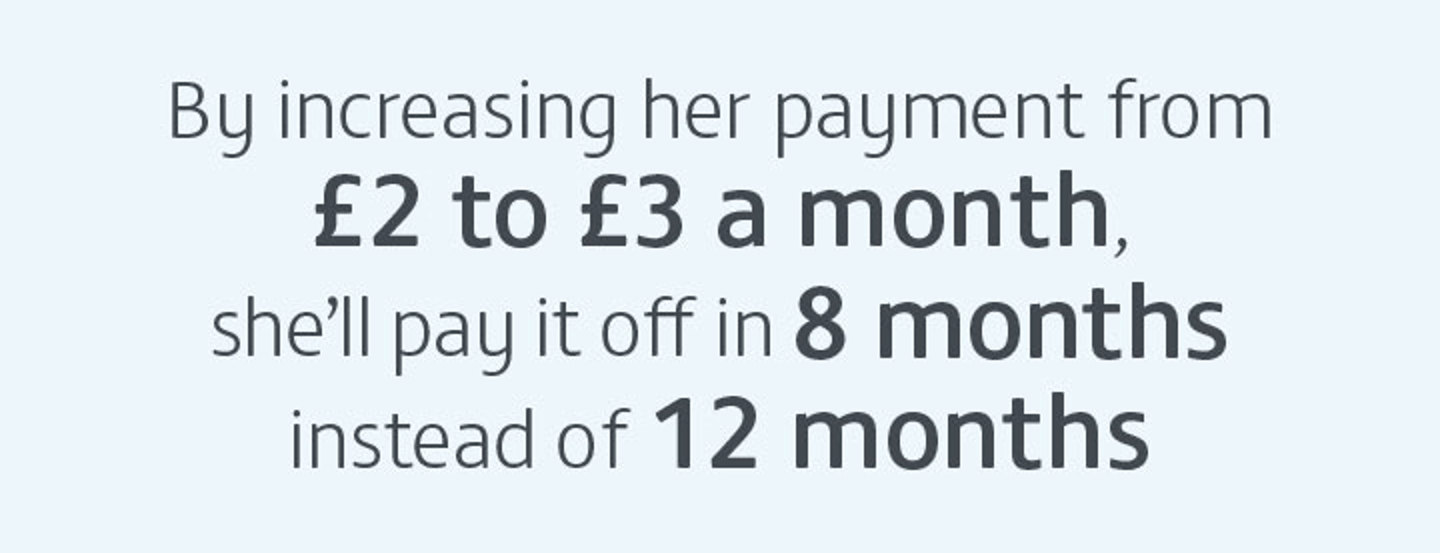

Sarah

Sarah was was doing OK paying off a loan for a new fridge until she had to quit her job in a care home. When she became a Lowell customer, she started paying £2 a month but when she found a part-time job in a local shop, she was able to increase to £3 a month.

*Examples are for illustration purposes only

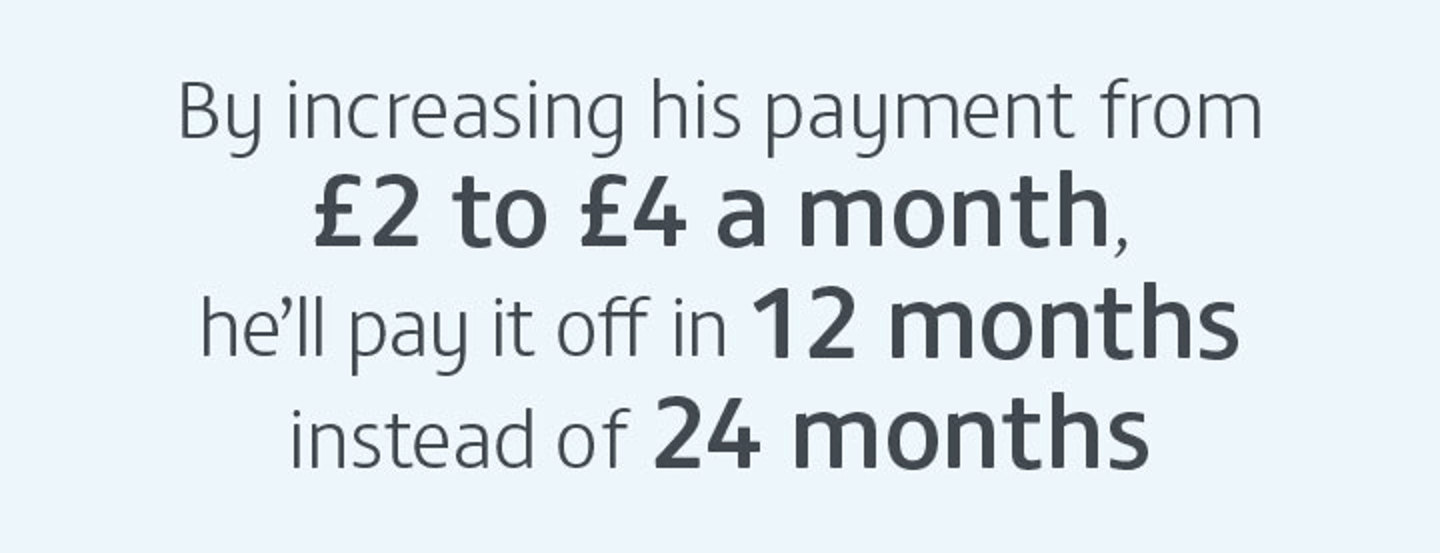

Hamza

Hamza was paying £2 a month off a debt for a mobile phone that he bought just before his van broke down. As he was a delivery driver, he lost most of his income. Now things are looking up again, he’s paying more to clear his debt and get a new van.

*Examples are for illustration purposes only

£15 billion of benefits are unclaimed. Are you getting yours?

Every year, people miss out on around £15 billion of benefits. Don’t be one of them. Find out what benefits you could be claiming.