How to Talk to Yourself About Money

Having money worries on your mind can really weigh on you, so it's important that you feel able to speak to yourself and loved ones about money.

Running from the 18th-24th March 2024, Debt Awareness Week is all about letting those struggling with debt know that they’re not alone, and that there are places to turn for expert guidance and support.

At Lowell, we know that you can get into debt no matter your age or situation, and that having the right financial knowledge can make a huge difference when it comes to dealing with your debt.

To find out more about how financial decisions made in younger years could affect people later on in life, we decided to do our own research focusing specifically on Gen Z, the generation born between 1996 and 2012, and how they’re managing their money.

Currently, Gen Z are at the age where their current financial habits will end up affecting them later down the line. Combining that with the likes of easy payment methods like contactless spending and buy now pay later (BNPL), as well as the current cost of living situation, they’re also having to navigate a world where managing money isn’t easy.

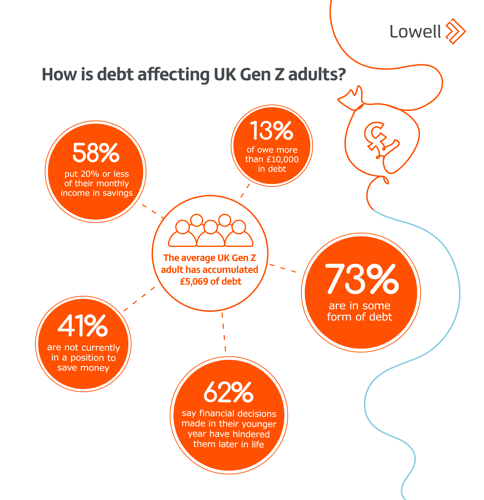

With that in mind, it may not be too surprising to discover that 73% of those we surveyed said that they’re currently in some form of debt. Not only that, but we also discovered that the average amount of debt stands at £5,069. What’s more, 13% said that they owe more than £10,000.

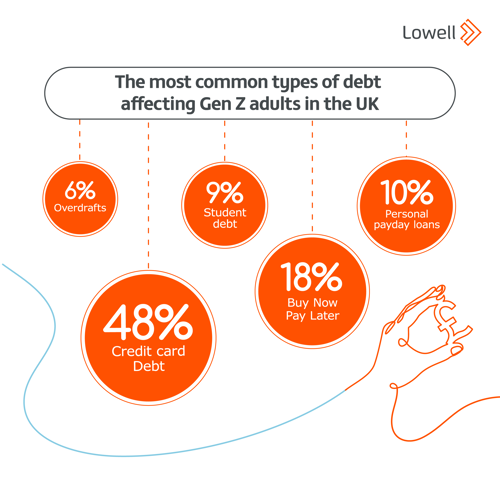

But what types of debt are younger generations struggling with? According to our research, the top three main causes of debt for Gen Z are credit card debt (48%), followed by buy now pay later (18%) and personal payday loans (10%).

It’s worth considering that with the rise of social media Gen Z have been, and continue to be, exposed to ‘finfluencers’ offering personal finance advice online. This also includes the promotion of certain financial services like BNPL and credit cards.

When it comes to finfluencer content, it’s important to remember that you might not be told everything you need to know, and that the information may even be biased or inaccurate. This is actually a topic we’ve previously explored in our mythbusting piece on the truth about debt advice online.

If you’re curious about whether you’re making the right financial decision, there are lots of independent organisations who offer free advice including Citizens Advice and MoneyHelper.

Whilst Gen Z may not have been financially independent for decades yet, it’s still possible that past decisions have already impacted their financial situation later down the line. In fact, 61% of respondents told us that they believe their current or future financial goals have been hindered by choices made in their younger years.

Perhaps the most obvious reason for why this might be simply comes down to a lack of financial knowledge. This time last year, we did some other research and discovered that a lot of people don’t know what common money terms actually mean.

Some particularly interesting findings included:

Given that a lack of financial knowledge leads to people making uninformed decisions, we created our very own debt dictionary to provide simple explanations for financial terms and jargon that we knew people found confusing.

Looking ahead, almost three in five respondents (59%) said that they’re able to save money for the future. On the other hand, it does also mean that over 40% are not able to do so or at least aren’t considering the potential impact of not doing so.

Delving into this a bit further into exactly how much Gen Z are saving, 29% of people said they’re putting 11-20% of their salary aside, yet 30% told us that they’re only saving 1-10% of their monthly income.

‘Soft saving’ is a term that has been used to describe Gen Z’s approach to saving for the future. Essentially, it’s all about putting less money to one side for later down the line and using more of it in the present, something which appears to be evidenced by our findings.

It’s never too soon, or too late, to start practicing healthy money habits, especially as this could really make a difference in both the short-term and long-term. Below are some things to consider if you’re looking to make the most of your money and avoid financial struggles later down the line.

Whether you’re applying for a credit card, taking out a loan, or setting up a payment plan to pay back outstanding debts, it’s important to always take time to read the terms and conditions of your agreement carefully.

The terms and conditions will include key details such as potential interest and fees, how much you can take out or how much you need to pay back, and what may happen if the agreement is broken.

To avoid overspending, it’s best to have a budget so that you can plan out where your money goes and keep costs under control. With a budget in place, you can see what money is coming in and out. This will then give you an idea as to how much you can afford to spend elsewhere.

If you’re unsure where to start, we’ve got a whole guide full of top tips on creating a budget as well as our very own budget calculator which can provide you with a simple summary of your finances.

From phishing and smishing to scam calls and loan scams, there are all sorts of different fraud methods that cybercriminals use nowadays. It’s also becoming harder to spot them as they’re a lot more sophisticated compared to just a decade ago.

It doesn’t matter who you are, practically everyone will have come across fraudulent emails and texts before. Here at Lowell, we want everyone to be aware of how to protect themselves, which is why we created a guide on the different types of fraud and how to spot them.

It’s important to remember that there is no one right way to pay off your debt. Whatever your circumstances, the team at Lowell want to work together to help you on your journey to becoming debt free with us. Please get in touch with our friendly team if you’re struggling or have any questions about your Lowell debt.

We understand that you might not feel comfortable speaking with a creditor, like Lowell, at the moment. If this is the case, there are other independent organisations that you can get in touch with for free expert advice including National Debtline and StepChange.

Commenting on the research John Pears UK CEO of Lowell UK said “Many young people have not had the financial education needed to successfully manage their financial health, resulting in many having already experienced problem debt. Debt Awareness Week, is an important time for raising awareness around the key triggers of problem debt, and encouraging people that they are not alone when dealing with it. Sadly, a worrying amount of people in the UK don’t know how to tackle their debt, and we hope our advice encourages people to take that first step to both acknowledging and dealing with their financial problems. We would also like to remind anyone feeling financial pressures to reach out for support, and a list of organisations who can help can be seen at https://www.lowell.co.uk/help-and-support/independent-support/”

Methodology

Survey of 1,000 Gen Z respondents conducted by TLF in March 2024.

Published by Stephanie North-Shaw on 20th March, 2024

Having money worries on your mind can really weigh on you, so it's important that you feel able to speak to yourself and loved ones about money.

Ready to take control of your finances? We know that saving money is easier said than done so we’ve created this guide of saving tips to help you make a start.