How to deal with debt-related stress

We understand that dealing with debt can be overwhelming and cause stress. To help ease your mind, read our guide on how to deal with debt-related stress.

Prioritising your health can be difficult, especially if you’ve got other things to focus on such as debt. From not being able to work or finding the money to pay for medical or energy bills, health issues can also affect your financial situation and ability to make debt payments.

Not just that, but trying to deal with your debt whilst struggling with your health can potentially lead to further problems, something we’ve explored in our guide on debt and mental health.

To find out more about the relationship between debt and health, we’ve conducted our own research revealing how many Brits have fallen into debt due to illness or injury and how it’s impacted their life.

A health issue, whether unexpected or not, can make it more difficult to stay in control of your finances. This does appear to be the case according to our research too as over one in five Brits (23%) have ended up falling into debt due to some sort of injury or another health issue.

But just how much debt are people getting into due to health issues? Obviously, the amount will vary depending on individual circumstances. However, when looking at our research, over a third of Brits (38%) have ended up running up over £1,500 in debt.

Here at Lowell, we know that when managing your money isn’t always straightforward, especially when circumstances suddenly change, this can potentially lead to problem debt. If you’re struggling with paying your Lowell debt, please do contact us so we can support you and find a way to work together.

With health issues sometimes leading to debt, we wanted to determine the main causes of why this might happen. Perhaps unsurprisingly, it turns out that increasing energy bills is the cause of financial difficulties for 43% of respondents. This is most likely related to the current cost of living situation in the UK impacting everyone but also the fact that having a warm home is important for certain health conditions such as heart or lung disease.

According to our research, the second most common reason is not being able to work due to an illness or injury, which is the case for almost two in five Brits. Not being able to get their full working salary means those with long-term health issues will likely have to rely on claiming statutory sick pay (SSP), and ultimately a reduced household income.

The overall cost of medical bills follows closely behind becoming a concern for 36% of those we spoke to. Other health-related factors that have affected people’s financial situation include having to install new features in their homes (15%) and moving to more suitable accommodation (13%).

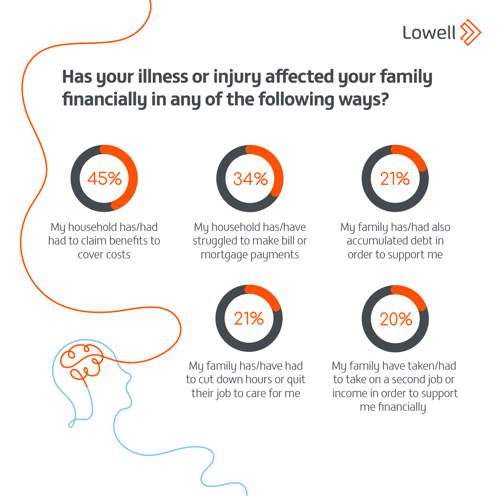

Now we know about the most common reasons why health issues might lead to debt, how is this affecting people financially? When it comes to trying to cover costs, 45% of households have had to start claiming benefits. Meanwhile, over a third (34%) of those with health issues are struggling to find the money to pay their bills or mortgage payments which may be due to not knowing where to turn for support or a delay in receiving any benefits.

Sadly, it seems that the financial struggles that can come with illnesses or injuries also affect others. In fact, 21% stated that their families have accumulated debt to support them with their financial struggles. Not only that but 20% have been so affected that their family has had to take on a second job to raise their income.

Of course, some people also require extra care due to their health issues. Over one in 5 (21%) are in a situation where their family has had to cut down on hours at work and, in some cases, even quit their job to take care of them.

Concerningly, of those we spoke to, 65% said that they’re not sure where to turn in order to get support or advice on dealing with their debt. At Lowell, we care about our customers and have heard about their experience with debt directly and through our customer panel. We know that being in debt can lead to feelings of worry, stress, and anxiety which is why it’s important to know that there is support available.

Part of our mission is being committed to helping our customers in any way we can, and below, we dive further into how to tackle debt when dealing with health issues.

If you’re in a situation where you need to take some time off work due to illness or injury, you might be able to claim Statutory Sick Pay (SSP). To be eligible you must:

· Be classed as an employee and have done some work for your employer

· Earn at least £123 per week on average

· Have been ill for at least 4 days in a row (including any non-work days)

There are some exceptions to SSP including if you’re self-employed or on maternity leave. For more information, you can read Citizens Advice’s guide on checking if you can get sick pay.

To help, we’ve got our very own benefits calculator that can help you make sure you’re not missing out on any additional support. Our in-depth guide on benefits and debt is another great place to find more information on this topic including the different types of benefits in the UK and if being in debt impacts benefits.

We understand that being open about debt isn’t easy, but asking for help is a good place to start if you’re struggling. For help with this, our blog on how to talk to a loved one about debt includes tips and conversation starters. There are also lots of organisations you can turn to who offer free and independent advice and support.

At Lowell, we want to support our customers however we can, and know that debt and health can be intertwined. Whatever your situation, if you’re struggling with your Lowell debt, please get in touch with us. Our friendly team receives specialist training to ensure that they are mindful and can find the best way forward for you.

To find more information on a range of financial topics and how we work at Lowell, you can head over to our Debt Guidance Hub.

Survey conducted by TFL Panel on behalf of Lowell, May 2

Published by Stephanie North-Shaw, 24th July 2023

We understand that dealing with debt can be overwhelming and cause stress. To help ease your mind, read our guide on how to deal with debt-related stress.

We understand that if you have debt, it can cause you stress, which may have an impact on your mental health. That’s why we’re here to support you if you’re going through a hard time.