The Debt Dictionary

Here at Lowell, we know that understanding finance and debt can be complicated, with plenty of confusing jargon and technical financial terms. That’s why we’re on a mission to help improve financial education. We want to help make it less confusing for you to manage your money and make it easier to understand the world of debt and finance.

When you don’t understand your finances, it’s easy to make financial decisions that aren’t right for you. To learn more about how financial misunderstandings affect people, we researched how much British people understand some common (and uncommon) money terms and myths.

Why is financial knowledge so important?

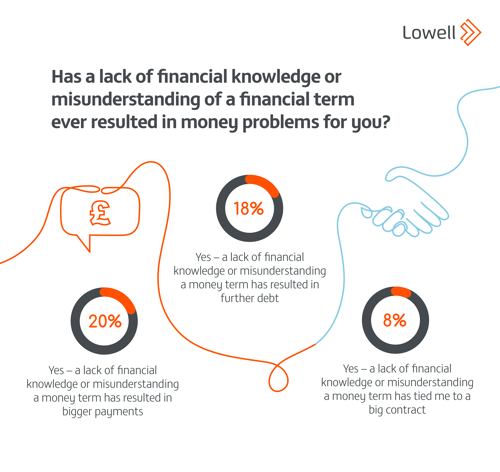

Our research has revealed that as many as one in five Brits (20%) are making damaging financial decisions due to their lack of money knowledge, with 18% having ended up in further debt due to not understanding a money term.

A general lack of financial knowledge and misunderstanding money terms from the people we surveyed meant that 9% of them had accrued over £1,000 worth of debt. In some circumstances, one in 50 (2%) even had over £10,000 worth of debt.

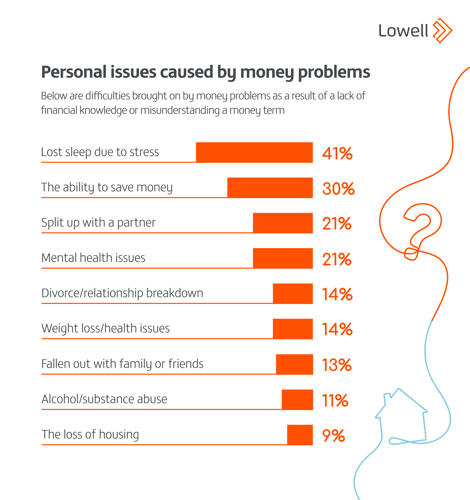

As well as the financial implications of not understanding some technical terms, Brits are also facing personal difficulties as a result of money problems brought on by a lack of financial understanding. From the people we surveyed, almost half (41%) have lost sleep due to stress, 21% have split up with their partners and 14% have even gone through a divorce.

Get more information

If you’re a Lowell customer and you’re struggling with debt, we’re here to help. Head to our debt guidance hub to find out more about different kinds of debt, and how Lowell works with customers to find the right path forward for you.

To find out which financial jargon terms are the most confusing (and what they actually mean) keep reading – our debt dictionary is here to untangle financial terms you might not understand.

We’ve sourced these definitions from reputable sources, but please bear in mind that Lowell do not offer financial advice and you should always check with an impartial third-party organisation, or with your credit or finance provider.

APR

You’ll have probably seen APR mentioned in adverts for credit cards or loans, but finance acronyms can be easily misunderstood. In fact, almost half of Brits (47%) don’t understand what it stands for, despite APR being a key part of borrowing credit.

What is APR?

APR stands for Annual Percentage Rate, and it’s definitely important to understand what it means. APR is designed to tell you how much it would cost you to borrow money over a year, including the interest and annual fees you’ll pay when you’re borrowing.

You’ll usually see APR described as ‘representative’. Representative APR is meant to help you quickly and easily compare different credit cards or loans, but because it’s ‘representative’ the actual rate you pay back could be different.

Arrears

A little over a third of Brits didn’t know the meaning of arrears. To be fair, it’s a term you might not hear often since it roughly means the same as a late or overdue payment, but it’s important to know this bit of financial jargon in case it ever affects you.

What does ‘being in arrears’ mean?

‘Arrears’ is a term used which relates to money that is now overdue and should have been paid earlier. Being in arrears is a breach of your contractual agreement as part of your agreement with the lender, was to adhere to payment dates and frequencies.

You may also hear reference to an account ‘being in arrears’. It means that you’ve agreed to make regularly scheduled payments when you signed the terms of a loan or agreement, but have missed one or more payments. Being in arrears is a breach of your contractual agreement.

Balloon Payments

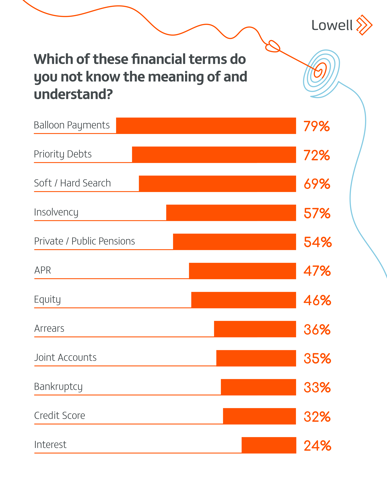

You might see the term ‘balloon payment’ when you’re looking at getting a car on finance – but despite it being commonly used in reference to PCP car finance, a huge 79% of Brits didn’t know what balloon payments were.

What is a balloon payment?

A balloon payment is usually a lump sum paid at the end of a loan term that’s larger than the other payments. It means you can have smaller fixed term payments for most of the loan term, and then a large lump payment at the end.

To find out which financial jargon terms are the most confusing (and what they actually mean) keep reading – our debt dictionary is here to untangle financial terms you might not understand.

Bankruptcy

33% of Brits didn’t know what bankruptcy is, despite it being one of the better-known debt management solutions in comparison to some of the other options available.

What is bankruptcy?

Bankruptcy is a legal process that can write off your debts if you can’t afford to pay them. It’s a serious step to take with some long-term implications, including having a big impact on your credit score and financial future.

Credit Score

Your credit score is a really important financial term to understand, but surprisingly a third of Brits didn’t know what their credit score is.

What is a credit score?

Your credit score is a number that uses your financial history to indicate how reliable you are at borrowing money and paying it back. It’s based on the information securely held in your credit file, which is like a financial CV - it shows your financial history, including credit you’ve applied for and credit agreements you’ve made in the past and the payments that you’ve made.

The credit reference agencies in the UK (Experian, Equifax, and TransUnion) use the information in your credit file to give you a numerical score on a 3-digit scale. Normally, the higher your score, the more likely you are to be approved for credit in future. If you’re a Lowell customer, you can check your credit score with TransUnion via your online account.

Equity

Equity has a few different definitions depending on the context. It can be quite complicated, which is probably why almost half of our survey respondents (46%) didn’t know the meaning of this little piece of financial jargon – even though anyone who’s bought or sold a house has probably heard it mentioned.

What is equity?

In financial terms, equity usually refers to a mortgaged property. In this context, equity means the difference between the value of your property and the mortgages or loans that you have secured against your property.

What is negative equity?

Equity is probably easiest to explain in terms of property. In property, equity refers to the difference between what you owe on your mortgage and the value of your house.

Negative equity is when you owe more on your mortgage than your home is worth – so if your mortgage was £120,000, and your home is worth £100,000, then you are in negative equity of £20,000.

Insolvency

A little over half of Brits (57%) didn’t know what insolvency is. It’s a term that covers a lot of different situations, so it’s definitely worth knowing the meaning, and what your next steps could be if you find yourself dealing with insolvency.

What is insolvency?

Insolvency means you can’t afford to pay your debts. If you’re unable to pay your debts, there are lots of different solutions to help you find a way forward. Each person’s financial situation is different, so there’s no one-size-fits-all method for dealing with insolvency.

If you’re having a tough time with debt, you can find out more about insolvency and other options in our guide to debt solutions.

Interest

Interest is one of the most important financial terms to understand for anyone with any kind of credit product, but almost a quarter of Brits don’t understand the term.

What is interest?

Interest is essentially the price you pay for borrowing money. It’s calculated as a fraction of the total amount of the loan or the money that you are borrowing.

For example, if you borrowed £100 with a 20% interest rate, the interest you would pay would be 20% of the original payment – so in this case, that would be £20. So, in total, you’d pay £120.

If you’re unable to make your payments as part of your agreement with your creditor, you may be charged additional interest which will increase the amount that you owe.

However, if you are a Lowell customer and you are actively working with us to help pay your debts, we won’t charge you any interest.

Joint accounts

More than a third (35%) of the people we surveyed didn’t know what a joint account was, but this common account type can have an unintended impact on your financial wellbeing.

What is a joint account?

Like priority debts, a joint account is also essentially what it sounds like – an account that you share with another person, often a partner or spouse. It’s important to know the details about joint accounts and joint debts because they can link you financially to another person, whether you’re in a relationship or just someone you live with and share bills with.

Even if you both have other separate accounts, having a joint account means that you and the other person are then linked financially. If you separate from someone that you share a joint debt with and one of you can’t or won’t pay, you’re both still financially liable for that debt. You can find out more about joint accounts in our guide to how to recognise if a debt is yours.

Pensions - private and public

Only around half of our survey respondents knew the difference between a private and public pension, but it can be a complicated topic that affects you in later life, so it’s always worth finding out more.

A pension is a financial product you use to save for your retirement. The value of a pension is usually based on how much money you’ve paid in.

What is a private pension?

A private pension is a way for you or your employer to help save money for when you retire. There are two kinds of private pensions – defined contribution and defined benefit.

- Defined contribution – This can be a workplace pension or a private pension that you arrange. Money that you or your employer pay in is invested, and the value of your pension can change depending on the performance of those investments.

- Defined benefit – often, this is a workplace pension, and it’s sometimes called ‘final salary’ because you’ll be given a certain amount each year when you retire. The amount you’ll get depends on individual scheme details, but often it’s based on things like your salary or how long you’ve worked for your employer.

What is a public pension?

A public pension is the workplace pension for public sector employees, like NHS employees, teachers, and civil servants – they’re often defined benefit pension schemes, and you’ll have your pension contributions taken from your salary as with most workplace pensions.

Priority debts

72% of the people we asked didn’t know what a priority debt is, making it one of the least-known financial terms in our survey. But it’s likely that most people have some form of arrangement or credit product that could be classed as a priority debt, which could cause you problems if you’re not able to make payments.

What are priority debts?

Priority debts are similar to how they sound – they’re debts that should take priority when it comes to paying them off, because they can cause you serious problems if they’re not paid.

Priority debts include

- Rent and mortgage arrears

- Council tax

- Gas, electricity, water, phone or internet bills

- TV licence payments

- Court fines and overpaid tax credits

- Unpaid tax (income tax, National Insurance)

If you have multiple debts or you’re not sure where to start, check out Citizen’s Advice for more information and support.

Soft / Hard search

A significant 69% of the people we surveyed didn’t know the meaning of a soft or hard credit check but knowing the difference could have a real impact on your credit score and finance options. If you’re ever applying for a credit product or loan, it’s important to know the difference between a soft and hard check.

What is a soft credit check?

A soft credit check is when a lender briefly checks your credit file to decide if you’re likely to pay them back and if they should lend to you. It doesn’t have an impact on your credit score and shouldn’t have an impact on any future applications.

What is a hard credit check?

A hard credit check is when a lender does a complete review of your credit file. Each hard check is recorded on your credit file, so other companies can see that there’s been a hard search. Having a lot of hard credit checks in a short space of time can have an impact on your credit score, which could make it harder to get credit or loans in future.

For more information on soft and hard searches, check out our guide to credit files and how it can affect you.

If you have any more questions about anything to do with debt, the Lowell debt guidance hub is here to help. We’ve created lots of easy-to-understand guides, explaining everything about debt, and walking you through how Lowell works with our customers.

First published: 20th February, 2023

If you're a Lowell customer and you have concerns or queries about your debt with us, then please do get in touch. Our friendly and supportive team will be more than happy to help.