Set up a plan

Set up a personalised payment plan, so that it works for you. It’s up to you to decide how much, when and how you want to pay.

Get startedFind out more about debt recovery, including the debt recovery process, what debt recovery agents do, and how Lowell can help you to mange your own debt.

At Lowell, we appreciate that trying to educate yourself on the important things you need to know about debt isn't always easy.

So, to avoid confusion, we've created a guide to explain everything you need to know about debt recovery in the UK.

This includes the difference between debt collection and debt recovery, the debt recovery process, and how you can work with Lowell to manage your debt.

It's easy to confuse debt collection and debt recovery as they are very similar, and people can use the terms interchangeably. This is because both terms refer to a creditor or company trying to resolve a debt by recovering money that has been left unresolved.

Putting it simply, both debt collection and debt recovery refer to when a creditor follows up with you about a debt, whether that's from their own internal team, or it could also mean that the creditor hires a debt recovery agent or another third-party to collect the debt on their behalf.

At Lowell, we buy debt from creditors, which means that we then own the debt outright. If your debt has been purchased by Lowell, we'll get in touch to talk about working with you to resolve your debt.

As we mentioned, debt collection and debt recovery are terms that can be used interchangeably. You can find out more detailed information about exactly what's involved in debt collection and what to expect in our guide to the debt collection process.

Perhaps you've lost track of what debt you have. It's important to know exactly how much you owe so that you can start the repayment process.

Here are some ways you can find out:

If you still can't find the right information from any of the above, as well as the above steps you can seek free, independent advice.

As a customer of Lowell, if you're not sure how much you owe or need some breathing space while you sort things out, just get in touch or manage your account online.

At Lowell, we want to make things as easy as possible for you. So if you've received calls or letters from us, do get in touch so that we can work together and find the best way to support you.

If you are contacted by a debt collector or debt recovery agent, it might feel stressful or worrying. But if you're worried or unsure, it's usually best to get in touch and see how you can work with them.

Companies like Lowell are a bit different - find out more about what happens if you ignore a debt company in our helpful guide.

Once you reach out, we can begin to work together to figure out a way to manage your debt that works for you and what you can afford. We also have a budget calculator that can help you take control of your finances and work out how much you might be able to pay.

As we've mentioned, debt collection and debt recovery are very similar things. Lowell is a debt collection company that purchases debt from other companies. This makes us the legal owner of the debt, so any money is therefore owed to us and not the original company you borrowed from.

We regularly buy debts from a range of different product and services providers, including utilities, banks and telecoms providers.

When purchasing debt, we always make sure that the information we're provided by the original company is correct, so that we can check the status of your debt, get in touch with you, and work together to sort out a payment plan.

Once your debt is purchased by Lowell, you'll hear from us so we can work together to find out how we can best support you. We have flexible ways for you to start clearing your debts depending on what works for you. We want to understand your situation so that we can set up a suitable payment plan that is sustainable and works for you.

At Lowell, our goal is to make sure that you're happy with your payment plan and that it is affordable and suitable for you.

Once we've gone through our budget calculator with you we'll be able to let you know how much money you have spare at the end of each month. From this, we can set up a payment plan and find out how long it would take to clear your debt.

We know that not everyone can pay as regularly as others, so you can choose if you would prefer to make payments weekly, fortnightly, four-weekly or monthly.

Lowell accepts a variety of different payment methods including direct debits, debit cards, cheques or standing orders. If there's another payment method you'd rather use or want to find out more about, check out the Ways to Pay Lowell page.

Don't worry if you're not comfortable speaking on the phone. If you'd prefer to set a plan or make payments online, you can register for a Lowell account online.

After your plan is set up, we'll email you or send a letter of confirmation. Then you'll only hear from us periodically to check that the plan is still working for you, or we might check in to make sure that everything is okay if you miss a payment.

If you're a Lowell customer and would like to change the details of your plan, or have had a change in circumstances, you can do this via the online Lowell portal, or by speaking to one of our friendly team.

We want to work with you, so if you've received calls or letters from Lowell then do get back to us so we can support you.

We want to make things as easy as possible for you. For more help and guidance on debt and how working with Lowell can help you, head to our Debt Guidance hub, or check out the Lowell blog.

First published: 24 June, 2022

Set up a personalised payment plan, so that it works for you. It’s up to you to decide how much, when and how you want to pay.

Get started

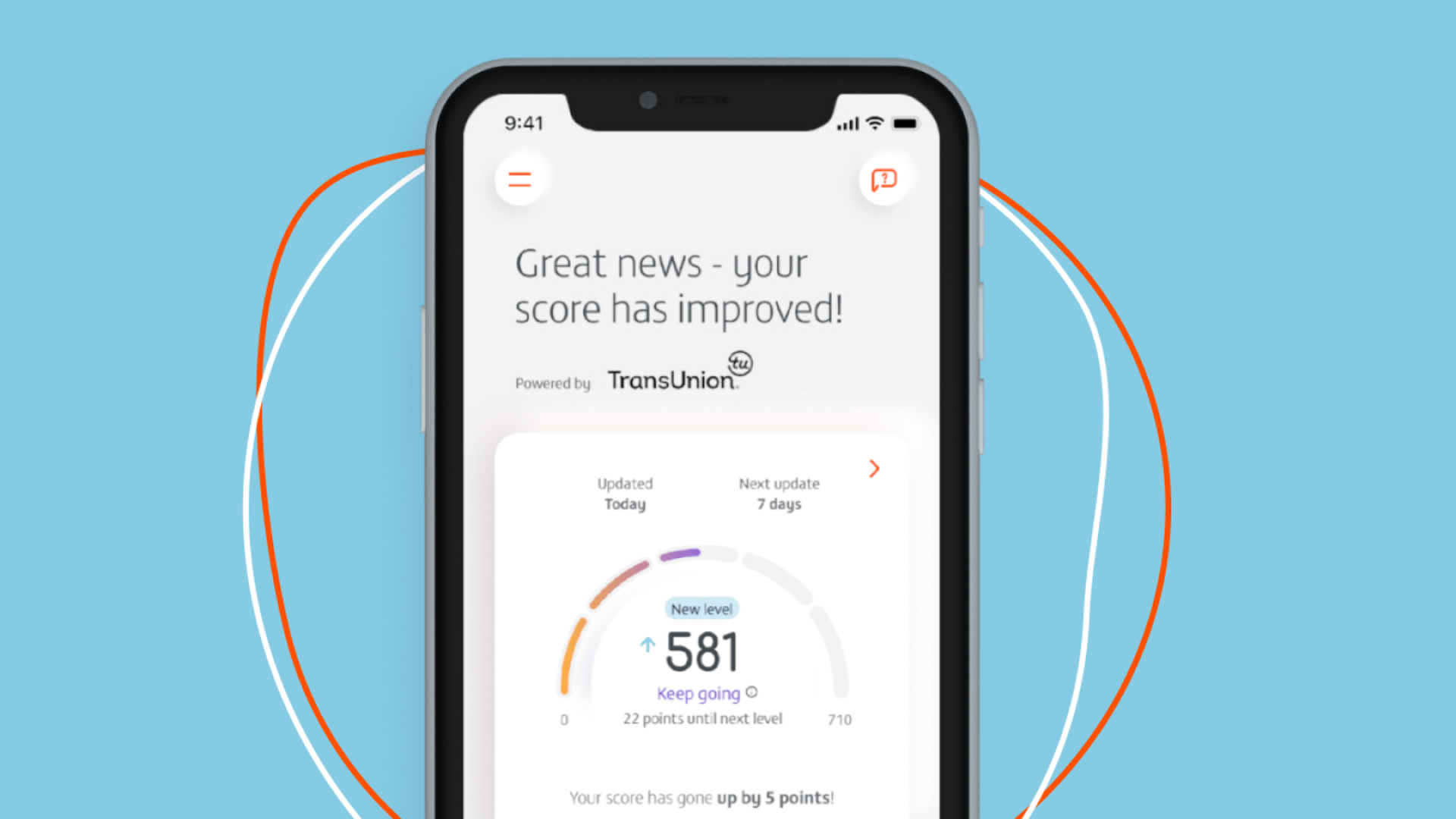

We partner with TransUnion, the credit reference agency, to give you access to your personal credit score

Get access

We’ve teamed up with Snoop, the free and independent money management app. It helps you track, sort and plan your money automatically, across all your accounts, in one place.

Find out more